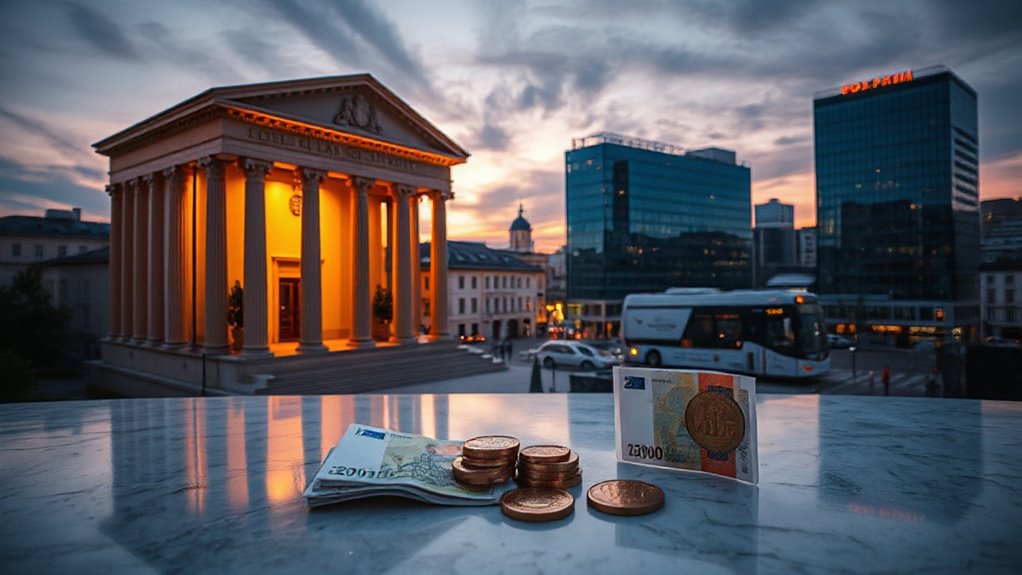

Bulgaria rang in the new year with a historic currency change, officially joining the Eurozone on January 1, 2026. The Balkan nation became the 21st member of the currency union, saying goodbye to the lev, its national currency for centuries. The word “lev” means “lion,” a powerful symbol in Bulgarian culture. To mark the occasion, euro coins were projected onto the central bank building at midnight as Bulgarians gathered in Sofia despite freezing temperatures.

Bulgaria bid farewell to the lev and embraced the euro as the 21st Eurozone member on January 1, 2026.

Getting into the Eurozone is not easy. Bulgaria had to meet four strict requirements called convergence criteria. These included maintaining stable prices, keeping government finances healthy, achieving favorable long-term interest rates, and demonstrating exchange rate stability. Bulgaria joined the Exchange Rate Mechanism II in July 2020, which helped prove its currency could remain steady. The lev remained pegged to the euro at 1.95583 BGN = 1 EUR throughout the transition period. Central banks play a key role in setting policy rates, which influence a country’s ability to meet those interest-rate related convergence targets, and Bulgaria’s adherence to such policies helped secure approval for accession to the eurozone by demonstrating policy rate stability.

The approval process moved quickly through 2025. Bulgaria formally requested a convergence report in February. By June, both the European Commission and European Central Bank published positive assessments. European finance ministers unanimously supported Bulgaria’s accession on June 20. The European Parliament approved the move just four days later with a strong 46-3 vote, and the European Council endorsed it on June 26.

For Bulgaria, euro adoption means more than just new money. The country now has a seat on the European Central Bank’s interest rate committee, giving it a direct voice in major financial decisions. European Commission President Ursula von der Leyen called it an “important milestone,” while ECB President Christine Lagarde warmly welcomed Bulgaria to the euro family. Membership provides access to the European Stability Mechanism, offering financial backstops that were unavailable under the previous currency peg arrangement.

However, not everyone celebrated. A Eurobarometer survey showed 49 percent of Bulgarians opposed the switch. The pro-Russian Vazrazhdane party organized protests, chanting “no to Euro colonialism.” Public skepticism and disinformation campaigns complicated the shift.

Bulgarian leaders emphasized the benefits. President Rumen Radev called it the “final step” in EU integration. Central Bank Governor Dimitar Radev described euro adoption as a “sign of belonging.” The move strengthens Bulgaria’s economic stability, increases its political influence, and provides greater protection against Russian interference in an uncertain geopolitical landscape.