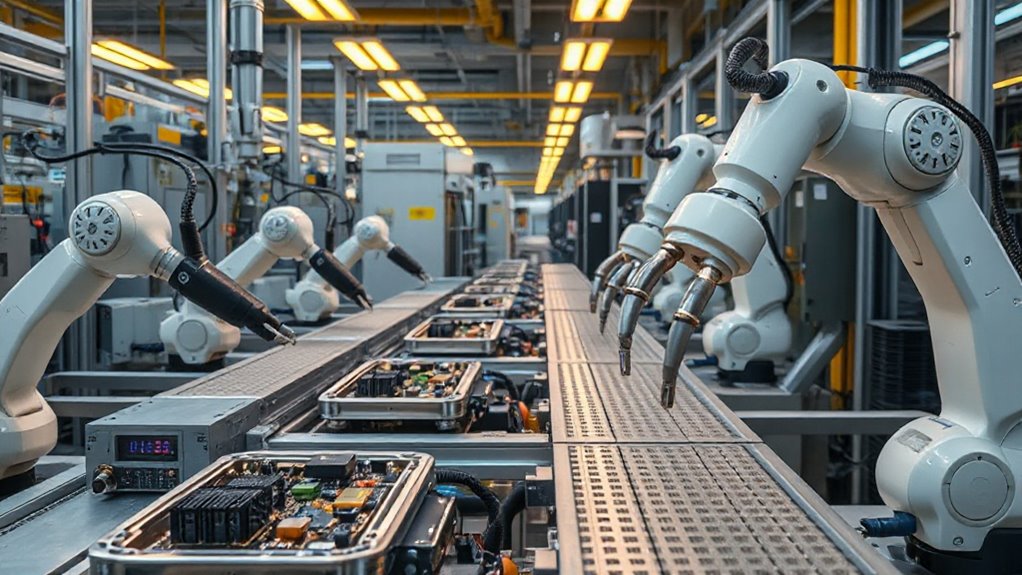

While tech giants grab headlines with their flashy robot armies, China’s small factories are quietly staging their own automation revolution. These scrappy underdogs are proving that you don’t need billion-dollar budgets to compete in the modern manufacturing game.

China has become the world’s largest market for industrial robots, with installations tripling from 2015 to 2024. The factory automation market reached $164.49 billion in 2025 and is projected to hit $279.94 billion by 2030. But here’s the surprising twist: small and medium enterprises are finding clever ways to join this high-tech party without breaking the bank.

Small factories are crashing the automation party with creativity, not cash, proving innovation doesn’t need billion-dollar budgets.

Take a small printing company that now uses QR code scanning software to track orders and monitor employee productivity. Or consider resource-limited manufacturers developing their own robotic quality testing machines. These businesses are embracing hybrid automation where humans work alongside robots, calibrating tasks and making smart decisions while machines handle the heavy lifting.

The Chinese government is cheering from the sidelines with serious financial support. The Made in China 2025 initiative includes a massive trillion-yuan state-backed venture fund. Provincial subsidies totaling $9.7 billion help small factories upgrade their operations. Government guidelines even mandate 70% domestic content in core automation parts by 2025. Some companies have already achieved fully humanless production environments, demonstrating the ultimate potential of this technological transformation.

Economic pressures are pushing these changes forward. Rising labor costs and severe worker shortages in manufacturing regions like the Yangtze and Pearl River Deltas make automation increasingly attractive. The pandemic also taught everyone valuable lessons about supply chain resilience. Advanced technologies like edge-AI predictive maintenance are enabling even smaller operations to prevent equipment failures before they occur.

Some impressive results are already emerging. Hybrid factory setups can reduce labor needs by 75%. Small programmable logic controllers grew 5.6% as smaller companies automate single-purpose stations. Robotic process automation delivers 30-200% return on investment in the first year for suitable processes. Like the forex market’s massive daily trading volumes that dwarf traditional exchanges, China’s automation market operates on an enormous scale that creates opportunities for participants of all sizes.

Of course, challenges remain. Financial constraints still prevent some companies from affording full automation expenses. Foreign firms dominate 90% of the high-end components market like ball screws. However, domestic robotics market share nearly tripled from 2015 to 2024, proving that determination and smart planning can overcome significant obstacles.

These small factories are showing that innovation doesn’t require unlimited resources—just creativity and courage.