In what may be the clearest sign yet that artificial intelligence is reshaping the tech industry, Samsung Electronics posted a jaw-dropping 20 trillion won in operating profit for the fourth quarter of 2025—the largest quarterly profit any Korean company has ever recorded. This figure represents a 160% increase compared to the same period in 2024, when the company earned 6.49 trillion won. The numbers tell a simple story: AI needs memory chips, and Samsung makes lots of them.

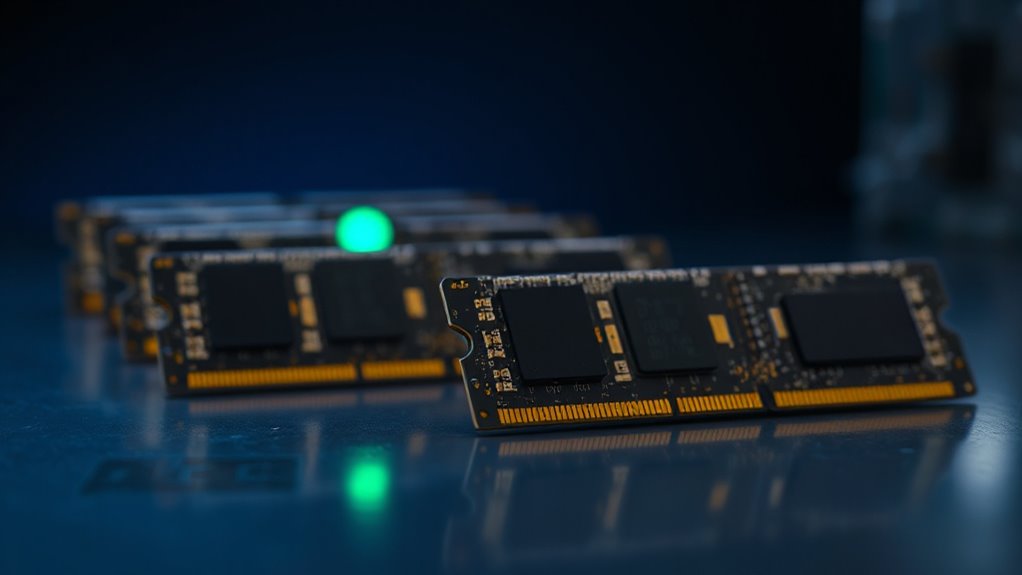

The memory chip division carried nearly all the weight, generating about 18 trillion won in operating profit—roughly 90% of the total. High-bandwidth memory, or HBM, emerged as the star performer. These specialized chips power AI systems that need to process enormous amounts of data quickly. Samsung’s sixth-generation HBM4 products proved especially popular, with shipments to Nvidia accelerating throughout the quarter. Data centers building AI infrastructure couldn’t get enough of these chips. Many investors are turning to full-service brokers for guidance on how to position portfolios amid the industry shift.

Sales figures reflected this surge in demand. Samsung’s fourth quarter sales reached 93 trillion won, up 22.6% from the previous year’s 75.79 trillion won. The company’s full-year 2025 sales hit 332.8 trillion won, setting a company record. The progression from the third quarter to the fourth showed momentum building rather than slowing down. Samsung’s fourth quarter operating profit exceeded market forecast of 18.5 trillion won by 8%.

Other divisions contributed modest amounts by comparison. The display business is expected to add 2 trillion won in operating profits, while the finished products division—which includes smartphones, televisions, and home appliances—will likely contribute 1 trillion won. Harman, Samsung’s automotive electronics subsidiary, should bring in around 300 billion won.

Looking ahead, financial analysts predict Samsung’s 2026 annual operating profit will surpass 100 trillion won. This optimism stems from the belief that AI-driven demand represents a sustained trend rather than a temporary spike. The semiconductor industry has completely reversed from the difficult period of 2023 and 2024, when excess inventory and weak demand plagued manufacturers. Now, AI applications are creating supply constraints where surpluses once existed. Samsung’s broad vertical range of manufacture and high production capacities positioned the company to benefit disproportionately from these market dynamics. For Samsung, timing this recovery proved extraordinarily profitable.