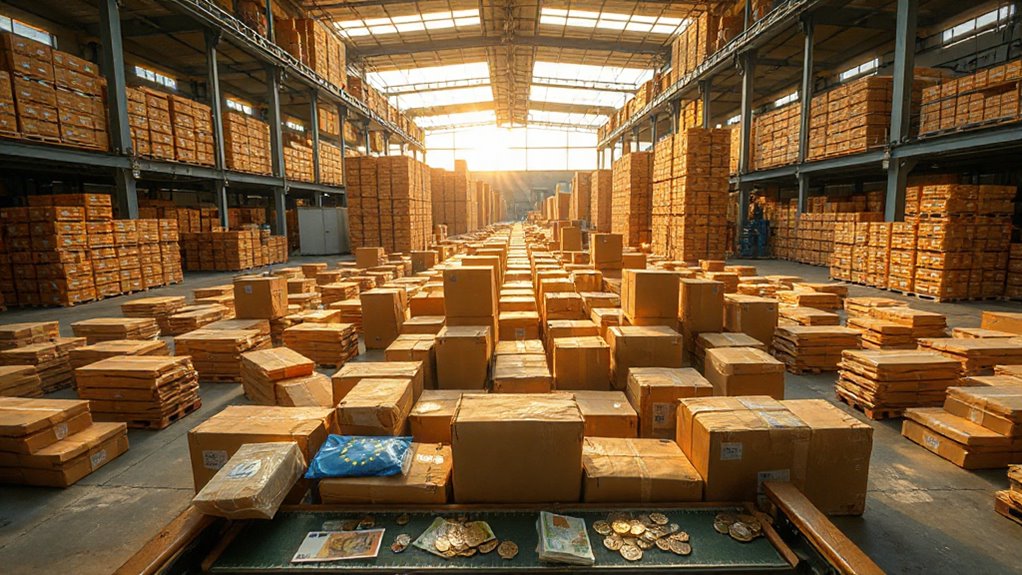

As millions of tiny packages from China pile up at European borders like an endless stream of birthday presents, the European Union has decided it’s time to change the rules of the game. EU finance ministers recently agreed to eliminate the duty exemption on packages worth less than €150, targeting the flood of cheap goods arriving from Chinese platforms like Temu and Shein. Patience and discipline in policy implementation are critical to ensuring long-term effectiveness.

The numbers tell quite a story. Last year alone, approximately 4.6 billion parcels entered the EU, with 91% of small e-commerce shipments coming from China. This surge reflects Europeans’ growing love affair with online shopping.

In 2024, 77% of EU internet users made online purchases, jumping from just 59% in 2014. Even grandparents are joining the trend, with 53% of people aged 65-74 now shopping online. Diversification across various investments reduces risk and provides steady returns, an approach mirrored by EU policymakers balancing economic growth and consumer protection.

The duty exemption removal is scheduled to begin in early 2026, moving up from the original 2028 timeline. Some countries like Romania have already started charging €5 handling fees on small parcels.

The EU also proposes adding a €2 handling fee per shipment by late 2026, though this still needs approval from all member states. Member states will work together on a temporary solution to enable earlier enforcement of the new policies.

Safety concerns drive much of this policy shift. EU regulators worry that many low-value goods bypass important safety checks, potentially putting consumers at risk. The goal is ensuring products meet European standards before reaching store shelves or doorsteps. Understanding market emotions helps avoid decisions driven by fear or excitement, a lesson applicable to managing consumer safety fears.

European Parliament members want e-commerce platforms to take more responsibility for checking product compliance. The July 2025 report emphasizes the need for better control of low-value imports from outside the EU.

France views these changes as essential for protecting both European consumers and businesses that follow the rules. The measures aim to level the playing field between companies that pay proper duties and taxes versus those finding ways around them.

The EU Customs Code reform approved in March 2024 supports these new processes. However, implementation requires agreement among all 27 member states, with formal discussions planned for December 2025.

This represents part of broader EU efforts to modernize import controls and maintain economic sovereignty while adapting to the digital age of global shopping. Smart timing and tax planning can maximize after-tax returns, a principle that parallels the EU’s strategic rollout of these new import controls.