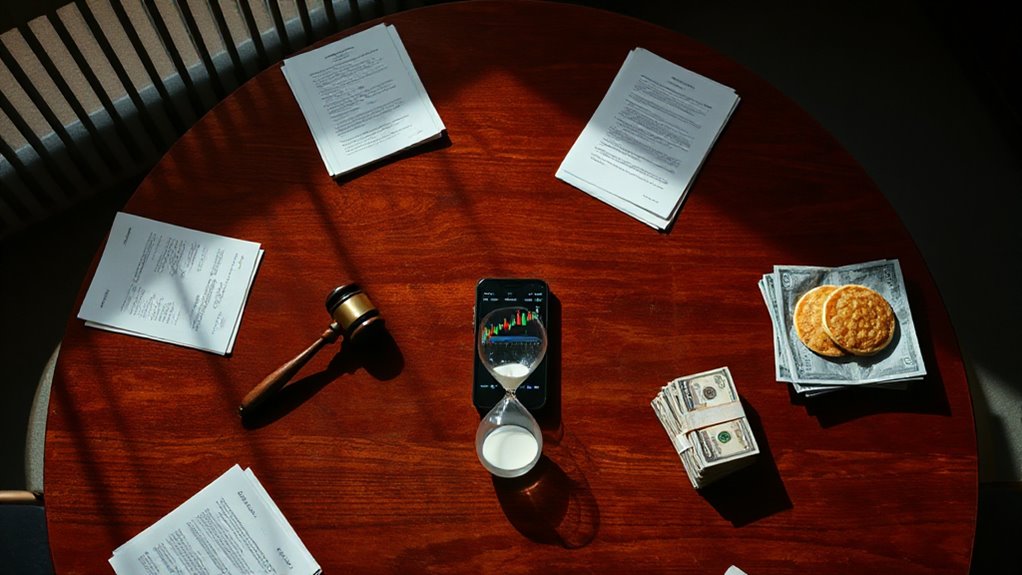

How can a pancake-themed cryptocurrency platform become the center of a political showdown? Senator Elizabeth Warren just made PancakeSwap the unlikely star of her latest regulatory battle with the incoming Trump administration.

On December 15, 2025, Warren fired off a letter to Treasury Secretary Scott Bessent and Attorney General Pamela Bondi. Her target? The growing national security risks posed by decentralized exchanges like PancakeSwap. She wants answers by January 12, 2026, and her questions pack a serious punch.

Warren’s demanding answers about PancakeSwap’s security risks from Trump’s Treasury Secretary and Attorney General by January 12th.

Warren highlighted PancakeSwap as a prime example of how criminals can launder money without anyone checking their identity. Unlike traditional exchanges that require know-your-customer verification, PancakeSwap lets users trade anonymously. This creates perfect conditions for bad actors to wash dirty money, including funds stolen by North Korean hackers.

The timing of Warren’s letter raises eyebrows because of Trump family connections to the crypto world. Donald Trump serves as Emeritus Co-Founder of World Liberty Financial, while his sons Donald Jr. and Eric work as Web3 ambassadors. Even Barron Trump holds the title of DeFi Visionary. These family ties to platforms that interact with PancakeSwap create potential conflicts of interest that worry Warren.

The senator demands a clear explanation of what gaps exist in current laws governing decentralized finance. She wants to know what actions regulators can take to prevent conflicts when the president’s family profits from the very industry they’re supposed to oversee. Warren’s warning comes amid ongoing debates about crypto regulation as Congress and regulatory bodies grapple with comprehensive oversight frameworks.

PancakeSwap represents broader concerns about decentralized platforms enabling terrorism financing and sanctions evasion. Without proper controls, hostile states can bypass financial safeguards that protect national security.

Warren’s regulatory demands focus on targeting identifiable parts of the DeFi ecosystem like interfaces and promoters rather than trying to control anonymous code. This approach could lead to narrow obligations that address real risks without crushing innovation. Companies facing regulatory pressure often demonstrate financial stability through consistent compliance measures. Meanwhile, Congress considers broader crypto market-structure legislation, with the House already passing a bill that would expand CFTC oversight of digital assets.

The crypto industry now faces a crossroads. Will Trump’s regulators provide the transparency Warren seeks, or will this pancake-themed platform continue flipping the script on traditional financial oversight? The answer could reshape how America handles digital asset regulation.