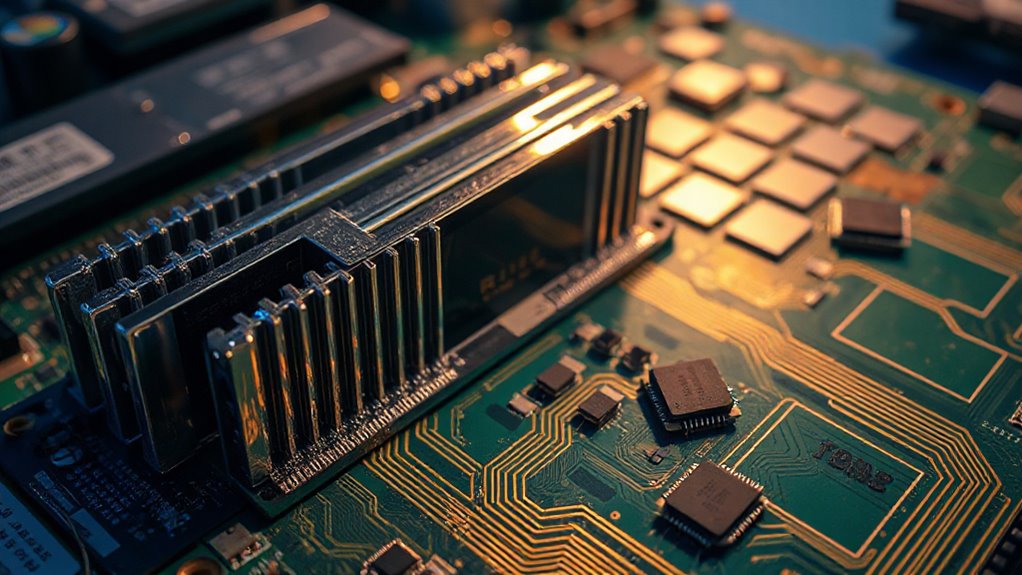

Dell is watching its profit margins shrink as memory chip prices climb faster than a rocket headed for orbit. The company’s chief operating officer, Jeff Clarke, admitted he has never seen memory chip costs rise this quickly. That statement carries weight when you consider Dell sells millions of computers and servers every year, and memory chips make up roughly 15 to 18 percent of a typical PC’s total cost.

Memory chip costs are skyrocketing at unprecedented rates, squeezing Dell’s profit margins as prices surge across their entire product line.

The problem stems from AI data centers hogging the world’s memory supply. AI servers need far more DRAM and HBM per machine than regular consumer PCs, creating a supply crunch that drives prices skyward. Memory makers are shifting their factories away from everyday computer chips toward the specialized high-capacity memory that AI systems demand. Hyperscalers and AI server manufacturers get priority because they place massive orders and pay premium prices, leaving fewer chips available for Dell’s PCs and laptops.

Industry watchers project DRAM prices will spike sharply again in the first quarter of 2026. Micron‘s decision to discontinue its vital consumer brand to focus on higher-margin AI memory shows how deeply the industry is restructuring around artificial intelligence. Dell faces cost increases not just in DRAM but also in SSDs and other storage components, making the situation harder to manage. Every wafer allocated to HBM for GPUs reduces the capacity available for consumer SSDs and standard memory modules.

To protect its business, Dell plans price hikes of 15 to 20 percent on servers and around 5 percent on PCs starting as early as mid-December. Executives describe these memory and SSD cost jumps as more dramatic than usual and impossible to fully absorb. The company must choose between raising prices and risking lost sales or keeping prices steady and watching profits evaporate. Lenovo has already notified customers that current quotations will expire on January 1, 2026, urging them to place orders immediately to lock in existing prices.

The memory shortage also threatens the economics of AI-capable PCs. Microsoft’s Copilot Plus computers require at least 16 GB of RAM, while systems designed for local AI models increasingly need 32 GB or more. Higher memory requirements mean higher costs, and OEMs must either charge customers more or offer machines with less RAM, weakening the value proposition for AI PCs. Central bank interest rate moves can further complicate these pricing decisions by affecting borrowing costs for manufacturers and consumers.